Human Touch in Digital Banking

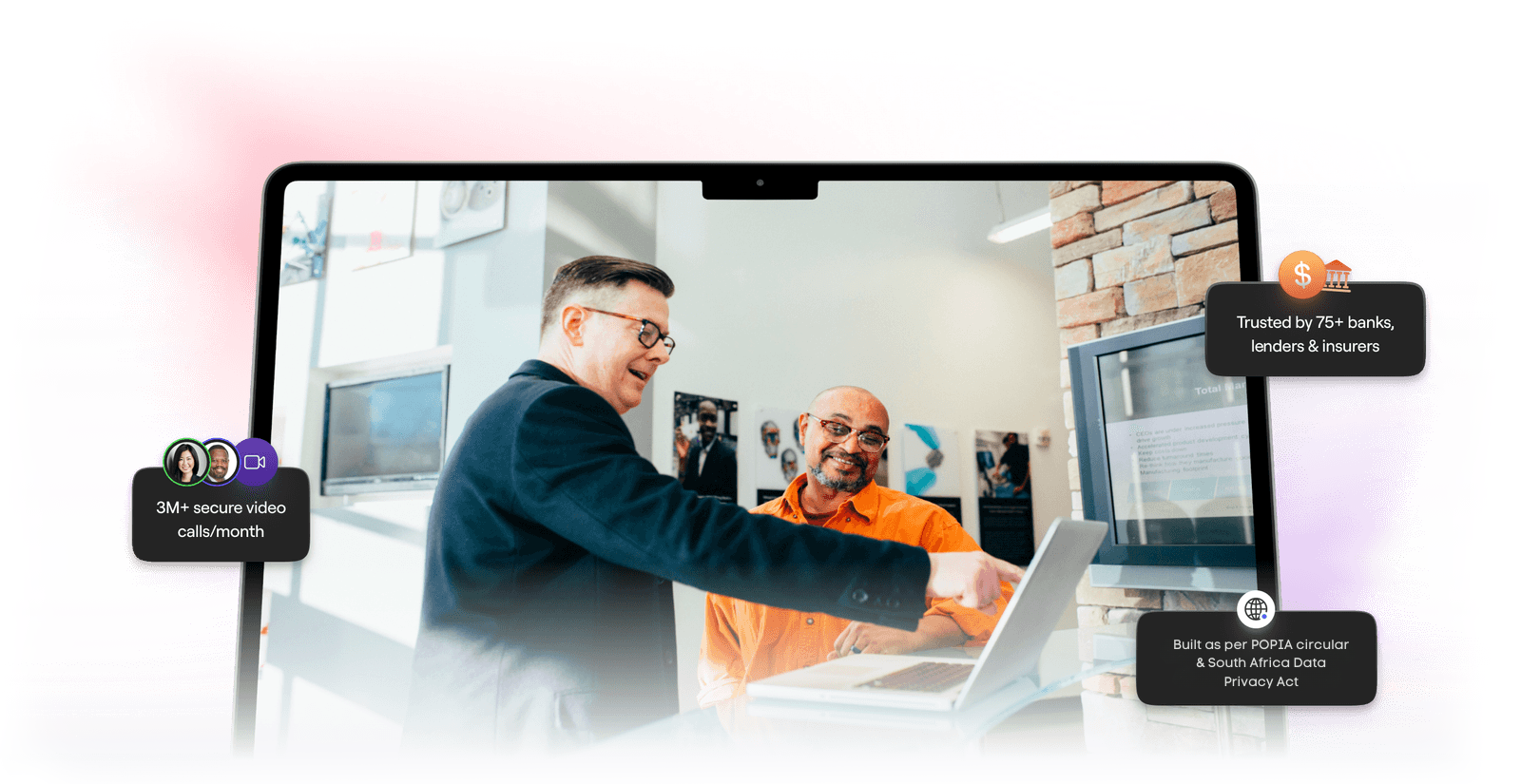

Deliver secure, face-to-face customer experience fromany branch, app or website – with worlds most feature rich video banking platform.

Trusted by global leaders

3+ million

video calls per month100+ Features

powering 44 product journeys5 AI Services

with 14 different use cases

Augment your branches while minimizing costs

Cost of

Physical Branch vs Video Branch

Cost of Physical Branch vs Video Branch

Our use cases

Support any physical, digital or voice-based

customer workflow using video for

better success and security

Configure your video branch in days, not months.

One Platform to manage your complete - Video Banking Journey

An AI enabled

video banking platform

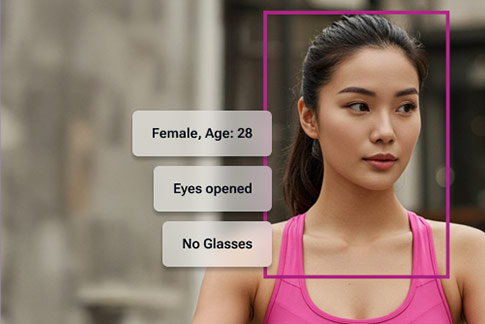

Face Match

An AI based face match that compares customers live photo with any document or previous photo.

Liveness Check

Face analysis - Analyse the customers photo for glasses, cap, gender, closed eyes etc.

Real time translation

An AI based face match that compares customers live photo with any document or previous photo.

Extract Text & Data

An AI based face match that compares customers live photo with any document or previous photo.

Speech to text

Get a transcript of the complete call with the time stamp and user specific comments.

Summarize transcripts

Call summary using Gen AI to quickly understand the conversation in a few lines.

Video analytics

Understand more about the call like sentiment, tone, pitch, emotion etc.

Book a case study walkthrough

Ahmer Hussain

National Business Head, Video Banking

AU Small Finance Bank Limited

“Video KYCs have helped us offer a completely new mode of account opening”

Sameer Shetty

Head, Digital Business And Transformation

Axis Bank

Ankur Jain

Deputy Head, Credit, Digitalisation

Tata Capital Financial Services

Rajesh Krishnan

Chief Operations & Customer Experience Officer

Bajaj Allianz Life Insurance

Aligned with POPIA circular & South Africa Data Privacy Act