Enterprise grade

Video Banking platform

for UK’s financial institutions.

Build trust, onboard faster, drop fewer leads and service better with secure video technology.

100

million video calls processed

44

product journeys

14

different use cases

100+

features

5

AI services

The state of Video Banking in the UK

Why Video Banking is no longer optional

With rising customer expectations and pressure to reduce branch costs, banks in the UK are accelerating their digital transformation pace, faster than ever before.

According to industry data:

- There’s a clear trend in the rise of digital first customers & their need for secure remote servicing.

- Over 50% of banking customers prefer human interaction online or are missing the human connection in banking.

- Leading banks in the UK are already piloting or deploying video-based services.

Yet, adoption is not uniform and this presents both a challenge and a first-mover advantage for institutions which are ready to leap ahead.

Challenges & Opportunities

Human Touch meets digital convenience

While live videos can humanize banking and reduce abandonment rates, many institutions struggle with:

- Balancing compliance with user experience & user experience is critical for digital adoption.

- Seamlessly integrate video banking services with existing backend systems (CRMs, onboarding, KYC, etc.)

- Ensuring data security and scalability, the cornerstone of every financial institution.

This is where a mature platform like VideoCX.io steps in.

Why VideoCX.io is the trusted Video KYC & Digital Onboarding Platform

25 Banks use our video contact centre for customer servicing and banking

A Global ISV Partner with AWS

AWS Global ISV

Hosted on Amazon Marketplace

AWS FTR approved

Case studies

Compliances

End to end encryption & GDPR compliant.

Modular Integration

Integrate VideoCX.io with your existing KYC software or digital onboarding tools effortlessly.

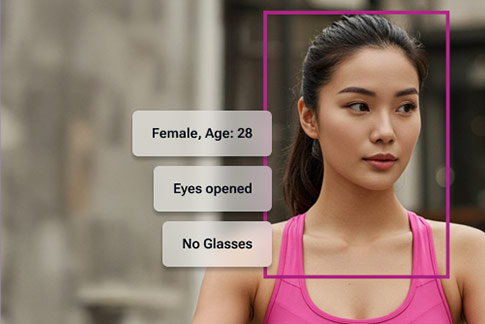

AI-Powered Workflows

Seamless integration with video KYC verification, ID verification services, and facial recognition systems.

Omnichannel Access

Web, mobile, embedded journeys, no app downloads required.

Instant Reporting & Audits

Every user session is tracked,

stored, and audit ready

Ideal video banking flow

Bank’s website or mobile app to host a video banking service section

Customer logs in or Customer is authenticated using an existing logged in session

Customer selects the service request and click on Connect

Bank’s system calls the VideoCX.io customer handshake API

Customer enters the queue and is shown a wait time (if all service executives are busy)

Customer gets connected to the next available service executive over a video call

Customer's required data is shared with the executive using the same API (Optional)

Customer can be authenticated using face match or profile verification (Optional)

Customer can get the queries resolved over the video call

Customer can share documents and IDs

Both are able to share their screens for journey assistance

Customer can make payments over the call

Complete video interaction is recorded and stored on bank’s storage device

Meta data and images collected on the call are passed using an API

The call recording and data is published in a bank for viewing later

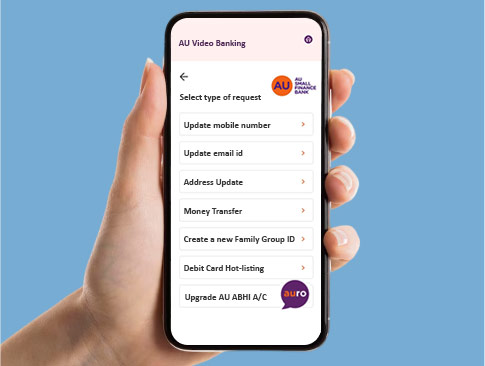

Use Case: AU Small Finance Bank Limited

Banking services support and fulfillment on video

14+ banking services available on a video call which customers can do through the bank’s mobile app or website.

Services include money transfer also.