Poonawalla Fincorp scales onboarding with RBI-compliant Video KYC by VideoCX.io

Poonawalla Fincorp adopted VideoCX.io’s secure Video KYC solution

to meet compliance, reduce costs, and streamline customer onboarding across multiple business lines.

At a glance

- Industry: NBFC (Retail Lending)

- Location: India

- Use Case: Video KYC for Customer Onboarding

- Journeys Covered: LAP, PL, BL, MEML, Pre-owned Cars

- Go-Live Date: November 2023

At a glance

- Industry: NBFC (Retail Lending)

- Location: India

- Use Case: Video KYC for Customer Onboarding

- Journeys Covered: LAP, PL, BL, MEML, Pre-owned Cars

- Go-Live Date: November 2023

Poonawalla Fincorp

Poonawalla Fincorp is a leading non-banking financial company (NBFC) in India offering a diverse range of retail lending products. To comply with RBI regulations and reduce operational costs, the company adopted VideoCX.io’s RBI-compliant Video KYC solution. This allowed the lender to digitize customer verification, strengthen fraud prevention, and eliminate branch dependency for KYC.

Challenges

- Regulatory compliance → Needed to implement RBI-mandated Video KYC with audit-ready trails.

- Branch dependency → Customers were required to visit branches for physical verification and document submission.

- High costs → Paper handling, logistics, and manual errors increased operational overhead.

Solution by VideoCX.io

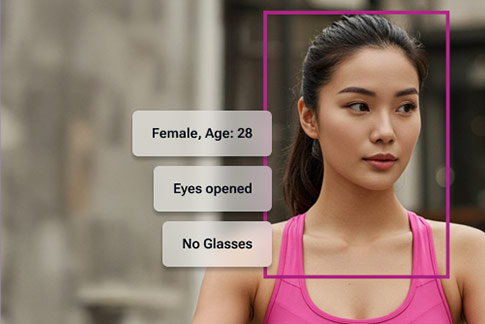

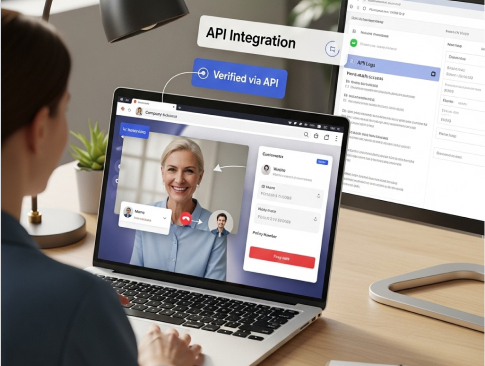

- 100 percent RBI-compliant Video KYC → Enabled digital verification with Aadhaar XML upload, location capture, random Q&A, liveness check, and OCR-based PAN validation.

- Enhanced fraud prevention → Face match powered by Amazon Rekognition ensured security and authenticity.

- Auditor module → Provided checker-based verification for additional compliance.

- Audit-ready evidence → All video recordings stamped with location and timestamp.

- Operational efficiency → Automated workflows reduced paperwork, errors, and turnaround time.

Implementation

- Pilot rollout → Launched across select business lines including LAP, PL, BL, MEML, and pre-owned cars to test compliance flows.

- Enterprise scale → Expanded after pilot with integrated auditor module and reporting dashboards.

- Training and support → VideoCX.io team trained relationship managers and auditors for smooth adoption.

Results & Impact

- Faster onboarding → Eliminated branch visits with KYC completed in minutes.

- Fraud prevention → AI-based checks reduced identity risks.

- Lower costs → Digitization reduced logistics and manual error costs.

- Regulatory confidence → Strong audit trails and encrypted storage ensured compliance.

Remove Branch Dependency from Customer Onboarding

Digitize KYC journeys across lending products using a secure, RBI-compliant Video KYC platform designed for scale and operational efficiency.

Discuss your Video KYC requirements

Explore more VideoCX.io’s case studies:

Read how leading banks have used VideoCX.io’s video banking platform to digitize customer onboarding and personal discussions, and customer servicing.

Lending: Godrej Capital | Protium Finance | Credit Saison | Aditya Birla Housing Finance | L&T Financial Services | IIFL Finance| SMFG India Credit | Tata Capital

You can also explore case studies across Banking, Life Insurance, and General Insurance.