Regulated financial work depends on evidence.

When a decision is challenged, reviewed, or investigated, the central question is simple: can the institution reconstruct exactly what happened, in the correct sequence, with proof that the record has not been altered?

As financial workflows move from branches to remote channels, that requirement has not changed. What has changed is the medium through which evidence must be created. Secure video, when designed as part of a governed workflow, can produce audit-ready trails that meet this expectation consistently across regions and regulatory regimes.

What audit readiness means in practical terms

Audit readiness does not start with technology. It starts with the ability to reconstruct reality.

An audit-ready workflow allows an independent reviewer to answer five questions without inference:

- Who participated in the interaction

- What information was exchanged and acknowledged

- When each step occurred

- How identity, consent, and access were controlled

- Whether the record remained intact after the interaction ended

Global standards on audit logging and accountability consistently describe these elements as the foundation of defensible evidence. The National Institute of Standards and Technology describes effective audit records as those that clearly capture event type, timestamp, source, outcome, and associated identity. This definition is widely referenced in security and compliance programs across industries and geographies.

Why traditional digital channels struggle to produce strong evidence

Many financial institutions still rely on fragmented digital trails. Chat logs live in one system, call recordings in another, approvals in a third, and advisor notes in a fourth.

This fragmentation introduces three structural weaknesses.

First, timelines become difficult to reconstruct. When records live in different systems, auditors must rely on correlation rather than sequence.

Second, context is lost. Text transcripts rarely capture whether disclosures were clearly explained or whether customer understanding was confirmed.

Third, integrity becomes harder to prove. The more systems involved, the harder it is to demonstrate a clean chain of custody for evidence.

Academic and industry research consistently shows that fragmented recordkeeping increases investigation time and operational risk. IBM’s Cost of a Data Breach Report highlights that organizations with poor visibility and governance face significantly higher breach and investigation costs compared to those with centralized control and logging.

Why secure video changes the evidence model

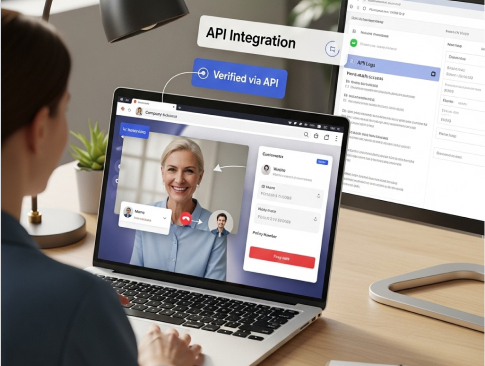

Secure video changes how evidence is created because it unifies interaction, context, and control inside a single governed session.

A properly designed secure video workflow generates evidence as a by-product of normal operations, not as an afterthought.

The session itself becomes the container for identity verification, consent capture, disclosures, explanations, confirmations, and supervisory visibility. This creates a single, time-ordered narrative that auditors can review without reconstruction.

The building blocks of an audit-ready secure video workflow

1. Workflow definition before the session begins

Audit quality depends on intent being defined upfront.

Before a session starts, the workflow should be classified. Examples include advisory discussions, claims clarification, hardship servicing, or exception handling. Classification determines what must be captured, retained, and reviewed.

This is where structured customer journey and routing becomes relevant. When routing and classification are systematic, audit outcomes become predictable and repeatable.

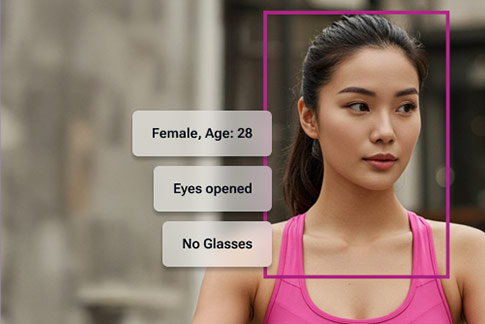

2. Identity assurance and access control

Evidence loses value if identity is Unclear.

Audit-ready systems record how participants were authenticated, whether additional verification was triggered, and which roles were allowed to perform which actions. This aligns with global risk-based authentication guidance referenced by financial supervisory bodies and industry security frameworks.

The result is a clear identity trail that links people, actions, and outcomes.

3. Consent and disclosure as recorded events

Consent and disclosure must be provable, not assumed.

Secure video workflows allow consent to be captured as a timestamped event and disclosures to be presented consistently within the session. Customer acknowledgements become part of the evidence trail rather than informal confirmations.

Privacy expectations are increasingly global in nature, shaped by frameworks such as the OECD Privacy Guidelines and ISO information security standards. Aligning consent capture with documented privacy commitments strengthens defensibility.

4. Interaction capture with contextual integrity

Recording is only one part of capture.

Audit-ready evidence includes the interaction itself along with supporting artifacts such as documents reviewed together, approvals granted during the session, and supervisory participation where required.

Security and audit research consistently shows that detailed, contextual audit records improve the speed and accuracy of investigations by enabling reviewers to reconstruct intent, actions, and outcomes directly from system evidence rather than inference.

5. Integrity, immutability, and infrastructure trust

Auditors care deeply about whether records could have been altered.

Secure video banking platforms designed for regulated workflows rely on tamper-evident storage, immutable access logs, and controlled export mechanisms. These controls are reinforced when platforms operate on well-documented, resilient cloud infrastructure, often described through assurances such as powered by AWS.

Cloud shared responsibility models and independent certifications play an important role in making integrity claims verifiable rather than aspirational.

6. Retrieval, supervision, and operational readiness

Evidence must be retrievable under pressure.

Audit-ready systems support structured search, role-based retrieval, legal holds, and supervisory review. These capabilities are central to global governance expectations around operational resilience and incident response

How this applies to real regulated workflows

In advisory and wealth interactions, audit-ready video records demonstrate that recommendations were explained clearly, risks were disclosed, and understanding was confirmed.

In claims or servicing workflows, they show how decisions were reached, what information was relied upon, and whether appropriate oversight occurred.

In dispute resolution, they provide primary evidence rather than reconstructed narratives.

Across all these cases, secure video reduces reliance on fragmented records and post-event interpretation.

Audit readiness as a trust signal

Trust in regulated finance is built through consistency and proof.

When institutions can demonstrate that every high-value remote interaction produces a reliable, time-ordered, and tamper-resistant record, they reduce risk while increasing confidence among regulators, auditors, and customers.

Secure video, implemented with governance at its core, supports that outcome by turning everyday interactions into defensible evidence.

In practice, this approach is implemented through workflow-embedded secure video architectures rather than standalone call tools. For example, videocx.io is designed to embed secure video directly into regulated financial workflows, allowing identity verification, consent capture, interaction records, and access logs to be generated as part of a single, governed session. If you are interested book a demo

Learn how secure video can support audit readiness in your workflows.