Across retail loans, SME credit, and high-value lending, institutions are under pressure to approve faster while still proving that every decision was informed, auditable, and defensible. This challenge is most visible in underwriting, where verification, judgment, and risk assessment traditionally required branch visits, paper trails, and sequential checks.

Secure video is changing this equation. Not as a replacement for credit discipline, but as a way to compress time without compressing judgment.

This article examines how secure video enables real-time underwriting, verification, and risk checks, while preserving the controls regulators and credit committees expect.

Why Lending Bottlenecks Persist Despite Digital Onboarding

Most lenders have already digitized the front door. Applications, document uploads, and automated checks are now table stakes. Yet underwriting delays persist because risk does not resolve cleanly through forms.

Common friction points include:

- Inconsistent or Unclear income disclosures

- Mismatch between documents and borrower explanations

- High-ticket loans requiring manual credit judgment

- Exception handling for thin-file or new-to-credit borrowers

- Regulatory expectations around borrower consent and intent

According to McKinsey & Company, lending journeys often break at the point where automation hands off to humans, creating delays, rework, and drop-offs when context is lost.

Secure video addresses this gap by bringing human verification and judgment into the digital flow, instead of forcing borrowers back into branches or asynchronous loops.

What “Secure Video” Means in a Lending Context

Not all video is suitable for credit workflows.

In lending, secure video must operate as part of a governed process, not a generic communication tool. That means:

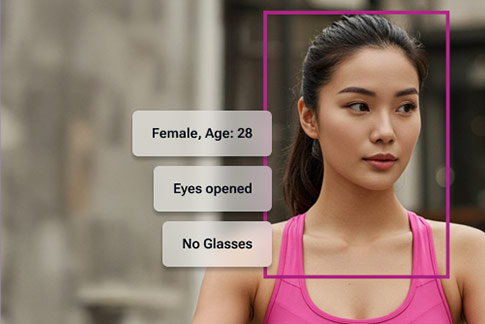

- Verified participant identity before interaction

- Explicit borrower consent captured on record

- Controlled session access and role-based participation

- Tamper-evident recordings with timestamps

- Full audit logs across every interaction

These capabilities are typically anchored in secure video underwriting features, rather than consumer video platforms.

This is why lenders evaluating video-based lending workflows often reference platforms designed around compliance and auditability, not convenience alone. A detailed view of these capabilities is typically documented in a platform’s Full Feature List, rather than scattered across marketing claims.

Compressing Underwriting Timelines Without Diluting Risk Controls

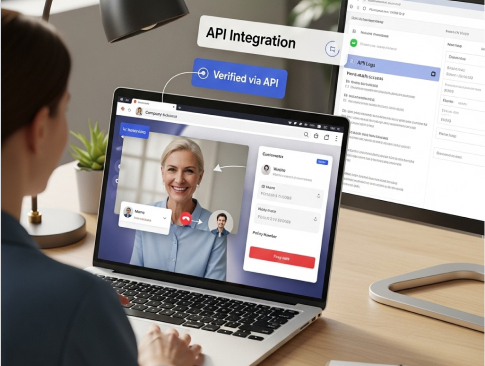

The primary advantage of secure video in lending is parallelization.

Instead of sequential steps spread across days, underwriting teams can perform multiple risk checks within a single governed interaction.

1. Real-Time Identity and Intent Verification

Secure video allows lenders to:

- Validate the borrower’s identity.

- Verify the borrower’s location during call & cross verify with submitted details.

- Cross-check documents against real-time responses.

- Confirm intent, purpose, and understanding of the loan.

This matters because many fraud and misrepresentation cases occur not due to fake documents, but due to misaligned intent.

The Bank for International Settlements has repeatedly emphasized that effective risk management depends on understanding both customer identity and behavior, not documents in isolation.

2. Human Judgment Where Automation Falls Short

Credit risk is rarely binary.

Borderline cases often require a credit officer to assess:

- Stability of income

- Business continuity for SME borrowers

- Borrower understanding of repayment obligations

Secure video enables human-led risk assessment within a structured environment. These interactions are often formalized as video-based personal discussions, where underwriting decisions are supported by recorded rationale, not informal calls or undocumented notes.

This approach aligns well with how senior credit committees expect decisions to be justified during audits or post-facto reviews.

3. Exception Handling Without Process Breakage

Traditional exception handling often forces borrowers into offline paths. Secure video allows lenders to keep exceptions inside the same digital journey.

By combining secure video with risk-based lending journeys, lenders can:

- Escalate higher-risk cases instantly

- Route borrowers to senior underwriters

- Maintain continuity across decision stages

Platforms that support intelligent underwriting routing allow these escalations to happen dynamically, without restarting the process or losing context.

Risk Reduction Through Visibility, Not Speed Alone

Faster decisions are valuable only if they are defensible.

Secure video reduces risk not by accelerating approvals blindly, but by making risk visible.

Audit-Ready Lending Decisions

Every secure video interaction produces:

- A verifiable record of who participated

- Evidence of what was disclosed and acknowledged

- Proof of consent and understanding

- A timestamped trail aligned to the decision

This creates lending records that are easier to review internally and externally.

The World Bank has highlighted that transparency and traceability are critical to responsible lending, particularly as institutions scale digital credit.

Fraud Deterrence Through Real-Time Interaction

Fraud thrives in anonymity and delay.

Live, secure video introduces friction for bad actors while remaining efficient for genuine borrowers. Subtle inconsistencies in behavior, hesitation, or explanations often surface during real-time interaction, even when documents appear valid.

This is why secure video is increasingly deployed not only in onboarding, but in credit decisioning and post-approval risk reviews.

Where Secure Video Delivers the Most Impact in Lending

While secure video can be applied broadly, its impact is highest in specific scenarios:

High-Value Retail and Mortgage Lending

- Larger ticket sizes justify deeper verification

- Borrower understanding and consent are critical

SME and Business Loans

- Business viability often requires discussion, not uploads

- Cash flow explanations benefit from dialogue

New-to-Credit and Thin-File Borrowers

- Traditional scoring models lack context

- Human assessment reduces false negatives

Risk Reviews and Credit Restructuring

- Decisions must be explained and documented

- Recorded discussions support governance

Many of these patterns are visible in how banks use secure video for lending, explore real-world Lending Case Studies and adjacent Banking Case Studies, where underwriting rigor and auditability are equally non-negotiable.

Governance, Privacy, and Borrower Trust

Borrowers are more willing to engage when interactions feel legitimate and protected.

Secure video platforms designed for lending incorporate:

- Clear borrower disclosures

- Explicit consent mechanisms

- Defined data retention policies

This transparency supports borrower confidence while aligning with regulatory expectations. Institutions typically reinforce this through documented data protection safeguards, reflected in formal privacy commitments rather than ad-hoc practices.

Secure Video as a Strategic Lending Capability

Secure video should not be viewed as a feature add-on. It is a decision infrastructure.

When embedded correctly, it allows lenders to:

- Shorten underwriting cycles

- Improve decision quality

- Reduce operational rework

- Strengthen audit readiness

Most importantly, it allows credit teams to apply judgment at speed, without sacrificing control.

Credit Decisions Are Strongest When Risk Is Seen in Real Time

Lending will always involve risk. The question is whether that risk is understood in real time or reconstructed after the fact.

Secure video enables underwriting teams to see, hear, verify, and decide within a governed environment, turning what was once a multi-day, fragmented process into a structured interaction measured in minutes.

For institutions evaluating how to modernize credit decisioning without eroding trust or compliance, it is worth discussing secure video lending workflows in the context of their specific risk models, products, and regulatory obligations.

If you would like to evaluate video-based underwriting for your lending operations, a structured conversation is often the most effective place to begin.