Tata Capital scales lending efficiency with VideoCX.io

Tata Capital transformed its underwriting and credit verification processes using VideoCX.io and AWS,

reducing processing time from weeks to hours while enhancing customer trust and reach.

At a glance

- Industry: NBFC (Loans, Investments, Wealth Management)

- Location: India

- Use Case: Video PD, underwriting, credit verification

- Spokesperson: Ankur Jain, Deputy Head – Credit Digitisation

At a glance

- Industry: NBFC (Loans, Investments, Wealth Management)

- Location: India

- Use Case: Video PD, underwriting, credit verification

- Spokesperson: Ankur Jain, Deputy Head – Credit Digitisation

Tata Capital

Tata Capital Financial Services Ltd. is one of India’s leading NBFCs, offering loans, investment solutions, and wealth management. As part of the Tata Group, it is committed to customer-centric financial solutions, innovation, and digital transformation.

Challenges

- Time-consuming processes – Loan processing often stretched up to three weeks.

- High operational costs – Travel, logistics, and branch dependency for verification.

- Limited scalability – Physical meetings slowed down credit officers and reduced productivity.

- Customer friction – Scheduling, travel, and paperwork created delays in loan approvals.

Solution by VideoCX.io

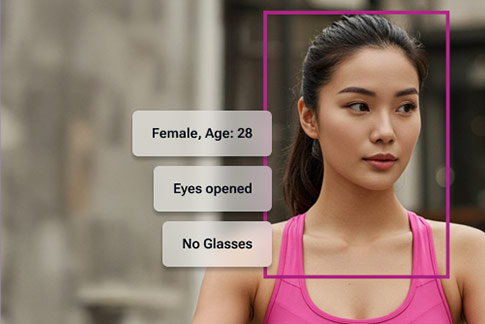

- Virtual interactions – Credit officers conducted underwriting and verification digitally.

- Secure, scalable platform – Powered by VideoCX.io and AWS, ensuring smooth video sessions.

- Digital records – Every interaction stored securely, ensuring compliance and transparency.

- Hybrid flexibility – Allowed seamless shift from physical to virtual without disrupting operations.

Implementation

- Pilot phase – Introduced during COVID-19 when physical meetings were restricted.

- Full-scale rollout – Expanded across credit underwriting and customer verification journeys.

- Training & infrastructure – Investments in staff training and secure storage to meet regulatory norms.

Results & Impact

- Time efficiency – Loan processing time reduced from weeks to hours.

- Cost reduction – Significant savings on travel and logistics for credit officers.

- Enhanced customer experience – Faster approvals with convenient, at-home interactions.

- Wider reach & inclusivity – Extended services to Tier-2 and Tier-3 cities, promoting financial inclusion.

- Stronger compliance – Robust audit trails and secure digital storage.

Testimonial

“Thanks to VideoCX.io and AWS also for making this journey far superior.”

— Ankur Jain. Deputy Head – Credit Digitisation.

Want to Achieve Similar Outcomes?

Learn how VideoCX.io enables NBFCs and Banks to handle growing loan volumes by replacing physical meetings with secure, scalable video interactions.

Request a detailed walkthrough

Explore more VideoCX.io’s case studies:

Read how leading banks have used VideoCX.io’s video banking platform to digitize customer onboarding and personal discussions, and customer servicing.

Lending: Godrej Capital | Protium Finance | Credit Saison | Aditya Birla Housing Finance | L&T Financial Services | IIFL Finance| SMFG India Credit | Poonawalla Fincorp

You can also explore case studies across Banking, Life Insurance, and General Insurance.