Why ask your customers

to visit a branch when you can

connect over a video call.

What is Video Banking?

- A video contact center solution, where customers can connect with bank executives over a video call.

- Have similar interaction as a physical branch and cater to any product sale or service request.

- Customers can dial into a video call from the bank’s mobile app or website.

- Bank executives could be centrally located in a call center, in branches, or could be Relationship Managers.

- White labelled, available on the bank’s domain, with 100% of the application and data hosted on bank’s server.

Benefits of Video Banking

- Fully digital and remote customer onboarding & servicing

- Highly convenient for customers to connect from anywhere

- Bank can have 24*7 operations

- Save cost of setting up physical branches in each city

- Customers can do secure and authenticated transactions

- Easier to manage a central team and operations than in each branch

Ideal video banking flow

Bank’s website or mobile app to host a video banking service section

Customer logs in or Customer is authenticated using an existing logged in session

Customer selects the service request and click on Connect

Bank’s system calls the VideoCX.io customer handshake API

Customer enters the queue and is shown a wait time (if all service executives are busy)

Customer gets connected to the next available service executive over a video call

Customer's required data is shared with the executive using the same API (Optional)

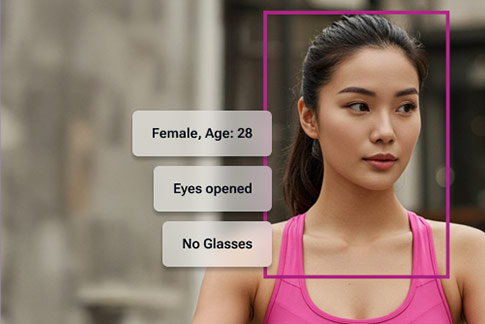

Customer can be authenticated using face match or profile verification (Optional)

Customer can get the queries resolved over the video call

Customer can share documents and IDs

Both are able to share their screens for journey assistance

Customer can make payments over the call

Complete video interaction is recorded and stored on bank’s storage device

Meta data and images collected on the call are passed using an API

The call recording and data is published in a bank for viewing later

One platform to manage your complete Video Banking journey

Integrate with your journeys

Customer routing logic

Customer queue management

Video call with customer

Additional features and workflows

Checker module for audit

APIs to sync data with other systems

Live dashboard and reports

Cost comparison between

a Physical branch and a Video branch

18,000 Rent + 12,000 for Utilities etc

10,000 for VideoCX.io license fee + 5,000 for AWS server fees

- Source: ChatGPT – https://chatgpt.com/share/6844775f-fa08-8002-8666-ae0242baaaf9

- Central teams can service more customers in a day than branch teams

- Manpower cost assumed to be same, though central teams require less managers

- Central teams can be trained and monitored better than branch teams